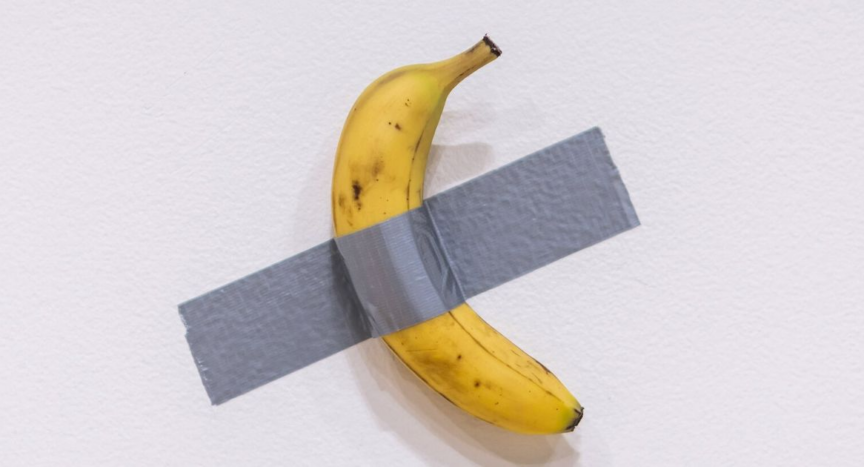

It wasn’t just a banana. It was a banana with a backstory.

The spectacle Wednesday evening, when a Sotheby’s auctioneer in New York warned potential bidders not to let Maurizio Cattelan’s fruity artwork “slip away,” ended with a duct-taped banana selling for an astonishing $6.2 million, with fees.

A crypto entrepreneur named Justin Sun placed the winning bid from Hong Kong, adding Cattelan’s 2019 conceptual artwork, titled “Comedian,” to the quirky collection he has amassed over the past few years that includes an Alberto Giacometti sculpture, a Pablo Picasso painting and a very expensive nonfungible token, or NFT, of a pet rock.

But winning the auction is really just the beginning of the negotiations that will take place over the next month or so (a buyer typically has 30 days to pay, by which time the banana will inevitably blacken and rot). In a phone interview this week, Sun said he intended to pay for the banana with his own invented cryptocurrency; however, Sotheby’s might only accept payment through more popular forms of digital payment such as bitcoin or ethereum.

Here are six questions you might have after seeing the ultrarich wave millions around for a piece of fruit — one that might well spoil from its own success.

What does $6.2 million actually get you?

Contrary to the crypto entrepreneur’s statement that he intended to “personally eat the banana as part of this unique artistic experience,” it would be unlikely that the actual banana presented at Sotheby’s would survive the plane ride to Hong Kong, even if refrigerated.

In fact, the duct-taped banana is only the physical representation of the conceptual artwork that Cattelan made for the 2019 edition of Art Basel Miami Beach, where it was originally sold for between $120,000 and $150,000.

Conceptual artworks are essentially ideas. What the artist typically sells is a certificate of authenticity and list of instructions for owners about how to maintain or re-create their purchases. Cattelan made three editions of “Comedian.”

Once his payment has cleared with the auction house, Sun will probably inherit the surprisingly detailed, 14-page list of instructions with diagrams that Cattelan has provided other collectors of the banana, including the Solomon R. Guggenheim Museum, which received a version of “Comedian” from an anonymous donor a few years ago.

The instructions include diagrams and an explanation of how the banana should be installed and displayed, including permission to replace the banana when it rots. Lena Stringari, the Guggenheim’s chief conservator at the time, said the instructions were easy to follow; they suggested changing the banana every seven to 10 days and affixing it about 5 feet, 9 inches above the ground.

A fresh roll of silver duct tape is included.

What does Cattelan get from this sale?

Nothing! Except a lot of attention.

Cattelan had already made an undisclosed fee when he originally sold the banana (the work is No. 2 of the three editions the artist made). It is the buyer who then consigned the banana for the Sotheby’s auction. Although artists receive a percentage of resales in countries such as the United Kingdom, France and Italy, that’s not the case in the United States, where companies have no similar obligations.

In recent years, artists have turned to blockchain tools such as NFTs to enshrine resale royalties into their sales contracts. Auction houses such as Sotheby’s have honored those contracts, even when the broader NFT market has largely abandoned them.

But artworks — whether traditional or unconventional, such as “Comedian” — have no provisions that would require a portion of Sun’s payment to be redirected to the artist.

“Auction houses and collectors reap the benefits, while the creator, who makes the very object driving the market, is left out,” Cattelan said in an interview before the sale. “NFTs offer royalties with every resale. Doesn’t it seem strange that the traditional art market hasn’t adopted a similar system?”

Why would anyone pay $6.2 million for a banana?

According to Sun, “This is not just an artwork; it represents a cultural phenomenon that bridges the worlds of art, memes and the cryptocurrency community. I believe this piece will inspire more thought and discussion in the future and will become a part of history.”

But more generally, participation in the art market provides the ultrarich with cultural clout, self-fulfillment and a sense of community. Building a collection is oftentimes a first step to joining the boards of museums and influential nonprofit groups, where the wealthy can establish their legacies and network with other businesspeople.

In recent years, the nouveau riche of the cryptocurrency world and other industries have also purchased artworks to promote themselves and their businesses. Even underbidders — people who fail to secure the winning bid — are often willing to reveal their identities for publicity’s sake. The morning after the “Comedian” sale, two crypto entrepreneurs, Ryan Zurrer and pseudonymous Cozomo de’Medici, said through a spokesperson they had also participated in the auction alongside five other groups of bidders who lost the artwork to Sun.

How much does a banana cost, again?

At a local fruit stand on Manhattan’s Upper West Side? Twenty-five cents.

The prices were a little steeper at the fruit stand outside Sotheby’s on the Upper East Side, where the auction house sourced its banana. The fruit vendor working there Wednesday evening, who is from Bangladesh, said a banana would cost 35 cents. He was unaware that only a few yards away, his Dole-branded banana would become an artwork valued at $6.2 million.

Overnight, that means the value of his banana had increased 18 million times. He did not respond to the question of whether his fruit stand would raise its prices.

Who is Sun?

Sun, 34, founded tron, a cryptocurrency. Last year, he was charged by the U.S. Securities and Exchange Commission with the unregistered sale of crypto asset securities, as well as manipulative practices that created the false appearance of strong investor interest for his digital currencies. The commission also accused eight celebrities, including actress Lindsay Lohan, of illegally promoting Sun’s cryptocurrencies. He has contested the charges, arguing in a court filing that the commission misapplied the law and does not have jurisdiction.

Born in China, Sun also has Grenadian citizenship, and he was for a time Grenada’s ambassador to the World Trade Organization. He still uses the honorific “his excellency” on the website of tron. In interviews, he has said he became fascinated by the crypto business after studying at the University of Pennsylvania.

Currently, he works with art adviser Sydney Xiong, who helped him purchase the $20 million Picasso painting at a 2021 Christie’s auction and the $78.4 million Giacometti sculpture later that year at Sotheby’s. Additionally, the adviser and entrepreneur have worked together on APENFT, a foundation that provides money to artists working to bridge the gap between the traditional and digital art worlds.

Enough monkeying around. Who believes a banana is actually art?

Artists have been pushing the boundaries of what defines art for centuries. A notorious example — and one that undoubtedly inspired Cattelan to conceive of his irreverent banana — comes from French artist Marcel Duchamp.

In 1917, Duchamp flipped a urinal onto its back and wrote the fictitious name R. Mutt on the porcelain, like an artist signature. He declared that the urinal had been turned into a sculpture called “Fountain,” much to the horror of that generation’s traditional art world. The artist also transformed commercial products such as rakes, stools and coat hangers into “ready-mades” that were accepted as sculptural artworks simply because he said they were. On Tuesday, at Christie’s, Duchamp’s “In Advance of the Broken Arm,” a snow shovel — titled, signed and dated on the handle, and suspended from the ceiling — went for $3.1 million.

With his banana, Cattelan was provoking similar questions about the role of public opinion and elite institutions in defining what is and is not art. But he was also calling attention to the art market’s appetite for anything — even a common fruit — that can be marketed and branded as a valid work of art.